| | Introduction | Canadian food retail industry | Changing landscape of Canadian food retail industry | How food retail industry is responding to these changes? | So what? | Sources of information | Return to Consumer Corner home page

.

Introduction

First it was Walmart. Now Target is opening stores, while numerous ethnic (largely Asian) large-format grocery stores are being built across the country. Canadian retailers are changing too, not only in preparation for these American ‘Big-Box’ retailers, but also to capture an increasingly diverse consumer base. This article provides you insights into the Canadian Food Retail industry.

Canadian Food Retail Industry

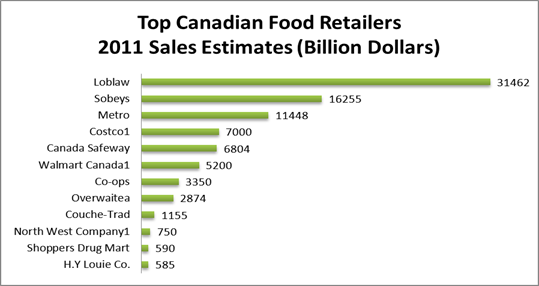

Industry sales for food retail stores is estimated $85.5billion in 2011 and it is projected to grow at a rate of 4.6% annually, as more Canadians choose to eat at home. The grocery market is highly concentrated and vertically integrated into food distribution. The top five retailers account for about 80% of total food sales.

According to Canadian Grocer (Executive Report 2012-2013), it is forecasted that Convenience Stores, Hypermarkets and Speciality Food Stores grow in value with higher percentages.

| Forecast Sales in Grocery Retailers by Category: % Value Growth 2011-2016 |

| % Value Growth |

| MODERN GROCERY RETAILERS |  |

| Convenience Stores | 9.9 |

| Discounters | 14.2 |

| Forecourt Retailers (gas bars with Convenience stores) | 3.6 |

| Hypermarkets (Walmart, Costco and Supercentres) | 41.3 |

| Supermarkets | 1.6 |

| TRADITIONAL GROCERY RETAILERS |  |

| Food/drink/tobacco Specialists | 10.8 |

| Independent Small Grocers | 8.5 |

| Other Grocery Retailers (bakeries, markets) | 7.6 |

Source: Euromonitor International in Canadian Grocer

Changing Landscape of Canadian Food Retail Industry

Canadian retail industry has been transforming due to combination of factors such as economic conditions, demographic shifts, changes in consumer behaviour and technology innovations.

Economic conditions: Compared to U.S, Canada’s economic conditions are suitable for retail market expansion. Canada’s GDP has shown a modest growth. Unemployment is declining and consumer prices are trending towards long-term stability. Canada has demonstrated less volatility. However, the exchange rate advantage over US dollar has disappeared and this will become a bigger issue for Canadian grocers.

According to Nielsen, despite the fact that Canadian recession is officially ended, 49% of consumers say that Canada is in a recession. However, Canadian consumer confidence continues to increase, but they are still showing spending restraints.

Demographic shifts: Baby boomers are expected to account for 21% of Canadians in 2026. As the population ages consumer products and services will need to adapt to meet their changing needs. The other change that shapes Canada’s market place is Millennials. Their influence on the market is strongly related to their financial power. They value quality over quantity, have a real passion for social causes and have grown up using internet for everything. Retailers who can appeal to this demographic section and offer them the products and experiences they value will be the most successful. The other biggest change is the increasing ethnic diversity in Canada. Increased importance of ethnicity will continue to redefine produce trends with more diverse selections and offerings.

Change in consumer behaviour: Aging consumers and rising awareness of the relationship between food choices and personal health is influencing the type of food products that consumers demand. Healthy eating has become a trend among consumers. Consumers are increasingly demanding fresh, natural and organic products. Consumers are also seeking ways to maximize the limited time they have for food preparation and this had created a great demand for convenience products.

Technological Innovations: Starting with self-service/ self-check- out aisle, and now, mobile platforms, smart sensors and social media have enable new ways of shopping. Shopping on mobile devices enabled online offers to be localized and personalized. As more stores adapt to Wi-Fi and the use of smart sensors around the store, shoppers will be able to use location based services which include checking product availability, locating products, identify alternatives and complementary. Tomorrow’s “smart consumers” will require all retailers to address the new ways they will shop and how they will expect to be served.

How Food Retail Industry is responding to these changes?

.

- American “Big-Box” retailers such as Walmart are expanding in Canada. According to Wal-Mart Canada’s recent press release, the retailer will invest $450 million for supercentre and distribution centre projects. Walmart is expanding rapidly after the acquisition of ex- Zellers stores and focusing on smaller store formats. Target arrived in Canada in March 2013. Whole Foods Market, a US-based upscale retail chain is also expanding into Canada.

- Empire Co., the parent company of Canada’s second-largest grocery chain Sobeys, acquired Safeway Inc.’s Canadian operations in June 2013. The deal positions Sobeys as a leading grocer in Western Canada and the largest grocer in Alberta with 234 stores combined. Sobeys expects to find cost synergies by integrating the distribution, information technology and procurement divisions of both grocers.

Note: Sobeys’ pro forma data is before any required store divestitures which may be required upon Competition Bureau review; provincial breakdown of 7 Walmart locations is unknown

(1) Sobeys for the 52-week period ended February 2, 2013;Canada Safeway for the 52-week period ended March 23, 2013

(2) Excludes affiliated independents

(3) Excludes 189 retail gas stations

(4) Excludes 71 retail gas stations

(5) Includes 10 liquor stores

(6) Supercentres only

(7) Excludes 186 pharmacies operating under the Brunet, Brunet Plus, Brunet Clinique and Clini Plus banners

Source: Empire Company Limited Announcement of Sobey’s Agreement to Acquire Canada Safeway, June 12, 2013 (presentation slides)

- Big retailers are testing new discount stores and acquiring ethnic grocery stores. For example, Loblaws is testing new discount stores in Calgary and acquired T&T ( Asian producer) supermarkets.

- Convenience Stores, Hypermarkets and Speciality Food Stores are becoming more popular due to their ability to provide convenient one-stop shopping experience.

- Retailing strategies used by companies reflect complex retail food market place. One example is Loblaw’s Guiding Stars nutrition navigation system with in-store registered dieticians to support consumers.

| Strategy |

| Emphasis on perishables |

| Development of private-brand strategy |

| Price differentiation |

| Unique shopping experience, store design and product selection |

| Emphasis on natural/organic products |

| Emphasis on consumer wellness and family health |

| Emphasis on ethnic products |

| Emphasis on one-stop shopping |

| Frequent shopper/loyalty program |

Source: FMI- The Food Retailing Industry Speaks 2011

So What?

- Recent developments in the Canadian retail food landscape have intensified the market competition. In general, this situation is beneficial for consumers as choice will continue to expand. However, consumers may be concerned about higher prices due to retail concentration in their local shopping areas.

- Concentrated retailers’ buyer powers are high. Retail buyers will constantly look to reduce price, improve product quality and extend the product range. This situation is challenging for small and medium scale food producers and processors (suppliers) to begin with.

- The acquisition of Canada Safeway by Sobeys may negatively affect some producers in western Canada if processing plants of Safeway are closed.

Sources of Information

- Acquisition of Canada Safeway by Sobeys, A presentation by Empire Company Limited, Sobeys Inc , June 12, 2013.

- Retail 2020: Reinventing retailing- once again. A joint project between IBM and New York University Stern School of Business, IBM Corporation, USA., 2012.

- Executive Report, Canadian Grocery Industry 2012-2013. Canadian Grocer, 2012.

|

|