| | Introduction | Pressing issues in the domestic consumer market | What we have learned from this study? | Study result considerations | Sources

.

Introduction

Over the past few years the Canadian domestic pork market has faced decreasing domestic consumption, low market prices and increasing imports affecting the industry. These conditions have prompted some stakeholders to consider using strategies to ensure a stronger domestic purchasing base in Alberta and Canada.

Under Growing Forward 2 initiatives, Alberta Agriculture and Rural Development undertook to analyse consumer level purchase data (food service, retail and import) to better identify the factors that contribute to decreasing domestic consumption. The research findings will allow the industry to address consumer needs to ensure a stronger domestic market.

This edition of Consumer Corner highlights the key findings from the study.

Pressing Issues in the Domestic Consumer Market

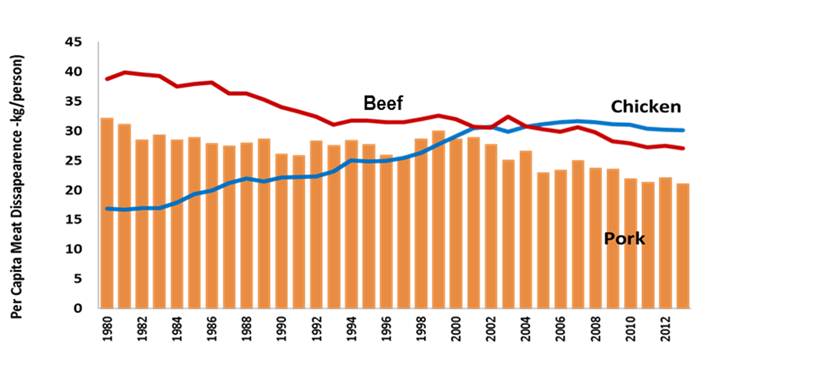

Per capita meat consumption of pork, indicated by Statistics Canada meat disappearance data, is decreasing in Canada. This decline is over 24 percent during the last thirty years. Chicken consumption has increased and although beef is decreasing too, it is at a slower rate than pork.

Figure 1: Per Capita Meat Disappearance in Canada (from 1980 to 2012)

Source: Statistics Canada

- Despite the recent increase, pork prices were generally low compared to red meat.

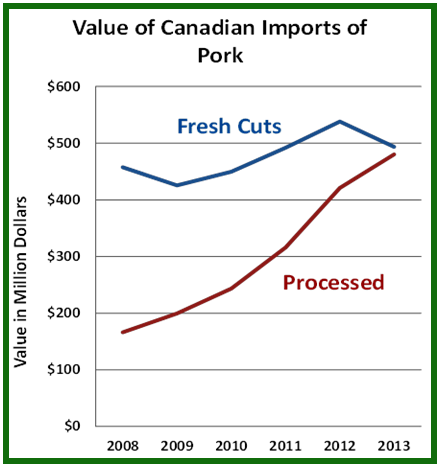

- Imports are increasing, especially for processed pork in Canada and for fresh cuts in Alberta

Figure 2: Pork Imports, Canada and Alberta (From 2008 to 2013)

Source: Statistics Canada

What We Have Learned From This Study?

Using three types of data, Alberta Agriculture and Rural Development has analyzed domestic pork consumption trends. These data groups include: a literature survey of pork consumption studies, food service sales and retail sales.

What has the literature survey on pork consumption studies reveal?

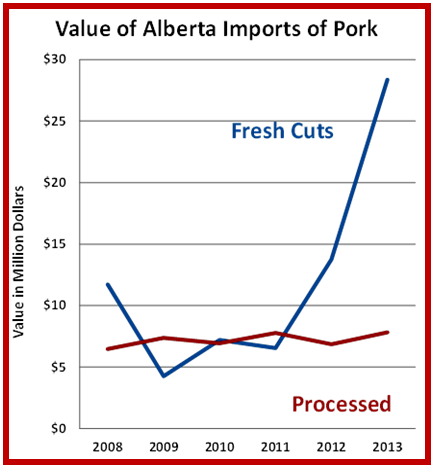

The top consumer concerns were healthy, safe, fresh, Canadian (local) and animal welfare for choosing products. A summary of the findings are provided in Figure 3. Additionally, a number of studies have emphasized the importance of having high-level promotional efforts to increase domestic pork demand. There is also a perception that certain food items are healthier based on one or more healthy attributes of that food - referred to as the health-halo effect.

Figure 3: A Summary of Literature Survey of Consumer Demand Studies

What has food service data revealed?

Food service consumer trends were analyzed using Technomic’s Beef and Pork Consumer Trend Report (2013) and food service Menu Monitor data (2014). Consumer’s perception of pork purchases revealed some interesting findings:

- While the market for beef is mature, pork demonstrates room to grow sales.

- There is potential to increase at home consumption by offering more convenient and easy to prepare products.

- Pork has the edge over beef in terms of its versatility across meal times (breakfast, lunch, dinner).

- Millennials strongly drive pork consumption, both at home and at restaurants.

- Using health-halo descriptors, particularly specific terminology, such as “steroid or antibiotic-free”, and ethical descriptors like “sustainable pork” may make pork offerings more appealing to certain consumers. These attributes could be used to position pork as an upscale option at higher price points to this consumer segment.

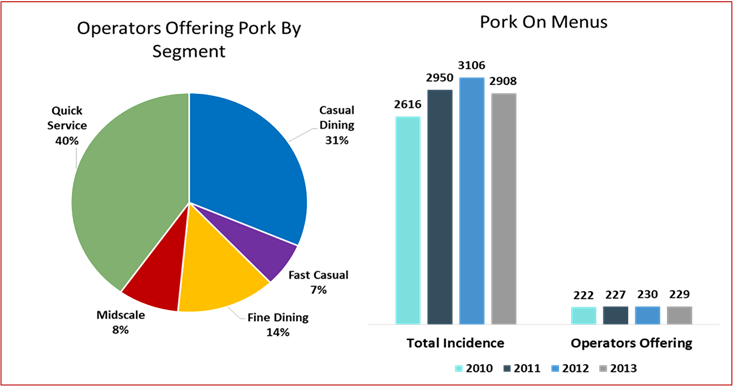

Consumer trends in pork consumption were also analyzed using food service menu data. Different food service

segments that offer pork on menus, total incidents of pork offerings and operators offering pork over a four year

period (2010 to 2013) are provided in Figure 4.

Figure 4: Pork Menu Offering Trends at Restaurants

Base: 262 Menus among Canadian Chains & Independents Restaurats

Source: MenuMonitor; Technomic, 2010 to 2013

Trends in pork menu offerings suggest that there was increasing demand for pork items from 2010 to 2012, but a decline in 2013. Alberta Pork’s ‘Passion for Pork’ campaign may have had an impact on the increasing trend.

What has retail meat sales data revealed?

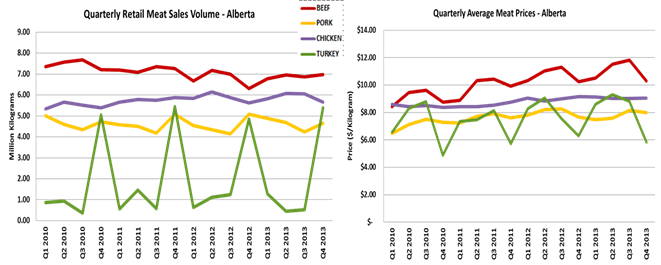

Trends in pork consumption were also analyzed using Nielsen Market Track retail sales data from years 2010 to 2013. Pork clearly shows lower average volume sales and lower price points than beef and chicken. However, retail sales of bacon, sausages and luncheon meat in Alberta show a 32 percent, 24 percent and 28 percent volume increase respectively from 2010 to 2013. Pork prices are clearly trending upward during this data period. It is interesting to note that average pork prices in Alberta are about nine percent higher than the Canadian average.

Figure 5: Quarterly Average Meat Sales and Prices in Alberta

Source: Retail Meat Sales, Nielsen Market Track Data, 2010 to 2013

Study Result Considerations

Insights and implications from domestic pork consumption trends.

- Decreasing pork consumption in Canada may be attributable to healthy eating trends, changing demographics, environmental and animal welfare concerns among consumers.

- Pork prices are lower compared to other red meats. However, this situation can be turned into an opportunity. Retailers may embrace the opportunity to market some less expensive meat items.

- Increasing imports, especially for processed pork in Canada and for fresh cuts in Alberta may point to the import environment, lower price points for imported pork or a lack of product differentiation. This situation may warrant industry considering enhancing pork processing capacity in Canada.

- In the food service market, pork demonstrates room for sales growth. There is potential to increase at home consumption by offering more convenient and easy to prepare options.

- There may be a strategic opportunity to profile Canadian pork products over imported pork products.

- Operators and manufacturers can make pork offerings more appealing to consumers using various methods. These include the use of health-halo descriptors such as “steroid or antibiotic-free” and ethical descriptors such as “sustainable pork”.

- In addition, using high quality breeds to obtain cuts which are lean, tender and flavourful may allow operators and manufacturers to position pork as an upscale option at higher price points for certain consumer segments.

- Trends in pork menu offerings suggest that there was an increasing demand for pork items from 2010 to 2012, but a decline in 2013. Although we did not do a systematic analysis, the “Passion for Pork” campaign launched by Alberta Pork in partnership with Alberta Livestock and Meat Agency (ALMA) may have had an impact on the increasing trend of pork menu offerings from 2010 to 2012. This may signal an opportunity to do further promotions of pork products. A number of academic research studies have highlighted the need for strong advertising and promotion in the domestic pork market.

- Retail data analysis showed only a slight decrease in sales, but a substantial increase in prices in Canada during the period from 2010 to 2013.

- Despite the decreasing sales of fresh pork, processed pork sales have increased significantly. This trend supports an opportunity to increase more value-added processing in Canada and to develop branded product lines.

- Pork prices in Alberta were about 9 percent higher than the Canadian average indicating strong demand in Alberta.

Sources

.

- Statistics Canada

- Technomic, 2014 MenuMonitor, data base

- Technomic, 2013, Beef and Pork Consumer Trends report, Canada

- Nielsen, 2013 – Retail Meat Sales. Nielsen Market Track Canada and Alberta 2010-2013.

|

|