| | Introduction | What do consumers believe about functional food? | Consumers want more | What drives functional food demand? | Industry perspective | Functional food & beverage new product trends | Challenge to producing functional foods | What does this mean? | Source

.

Introduction

The following is a summary of the functional foods ingredient market from research reports compiled by Packaged Facts, a market research company based out of Rockville, Maryland.

The concept of functional foods is not new, but what does this term really mean? Functional foods, first introduced in Japan in the mid-1980s, contain bioactive food compounds or physiologically active nutrients and non-nutrients. Antioxidant vitamins are an example of a nutrient-based bioactive food compound whereas flavonoids1 and isoflavones2 are examples of non-nutrient bioactive food compounds, all of which are being incorporated into products marketed as functional foods. While there is no legal definition for functional foods, a common definition is that a functional food provides health benefits beyond basic nutrition3.

Due to developments in ingredient technology, advances in scientific understanding of nutrients to promote well-being, better management of health conditions - health and wellness trends are driving the commercialization of new ingredients for food and beverages.

While there are many types of functional food ingredients, the ingredients listed in Table 1 below (functional food ingredients) are outlined based on the recent developments and attention these ingredients are currently receiving, or are expected to receive in the near future.

Table 1: Functional Food Ingredients

Functional Food Ingredients |

| Function | Functional Food |

| Protein | Assists with sustained energy, athletic performance and recovery, staves off loss of muscle mass with aging, helps with weight loss and management, curbing appetite and promoting satiety. | Protein is found in meat, fish, dairy, eggs, plant proteins such as, nuts, soy, grains, legumes, pulses, leafy green vegetables, and microalgae (chlorella).

Microalgae is a form of protein that has recently been added to manufacture food products such as: Alfredo sauce, brioche made with high lipid whole algal flour instead of the usual butter and eggs. |

| Vitamin D | Helps with bone growth, modulates cell growth and has a role in neuromuscular and immune function and reduces inflammation. | Vitamin D is naturally found in fish and shellfish.

Vitamin D is sometimes added to food products such as: fluid milk, yogurt, cheese, margarine, orange juice, soy beverages, meal replacement beverages, breakfast cereals, bread, grain products and pasta. |

| Magnesium | Magnesium works as a cofactor (critical to Vitamin D activity) to regulate protein synthesis, muscle and nerve function, blood glucose regulation and blood pressure regulation. It plays a role in bone development and in the transport of calcium and potassium ions across cells which is important for nerve impulse conduction, muscle contraction and normal heart rhythm. | Magnesium is naturally found in nuts, seeds, whole grains and legumes.

Magnesium is sometimes added to food products such as: ready-to-eat breakfast cereals, supplement bars and beverages. |

, |

What do Consumers Believe about Functional Food?

According to a recent survey4, the vast majority of Americans are aware of functional foods and believe that good nutrition can be used to manage health. Ninety per cent of Americans agree that certain foods have health benefits beyond basic nutrition and roughly the same percentage can name a functional food or food component and its health benefit.

Consumers Want More

Consumers acknowledge that they get some or most of the nutrients and dietary components they need for good health from food, but they don’t think they get enough and think they need more. Approximately three-quarters of consumers expressed concern that they are not getting the nutrients and food components they need for good health.

What Drives Functional Food Demand?

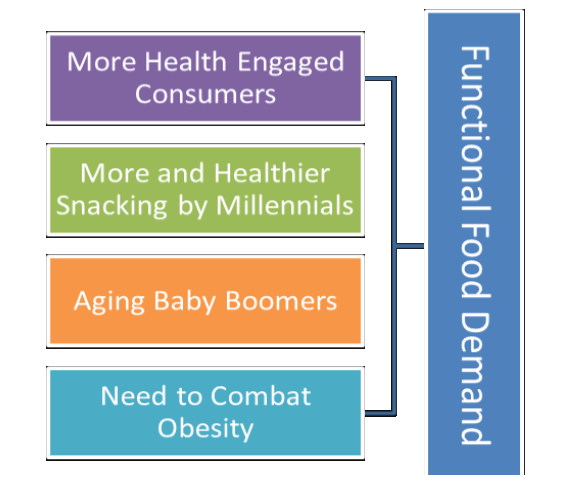

Increased consumer awareness of health and wellness across the age spectrum will continue to fuel interest in functional foods for the foreseeable future. It will also affect ingredients selected for use and potential claims to be made by food processors and marketers. The four primary drivers that will drive functional food ingredient trends are illustrated in Figure 1.

Figure 1: Key Drivers of Functional Food Demand

Industry Perspective

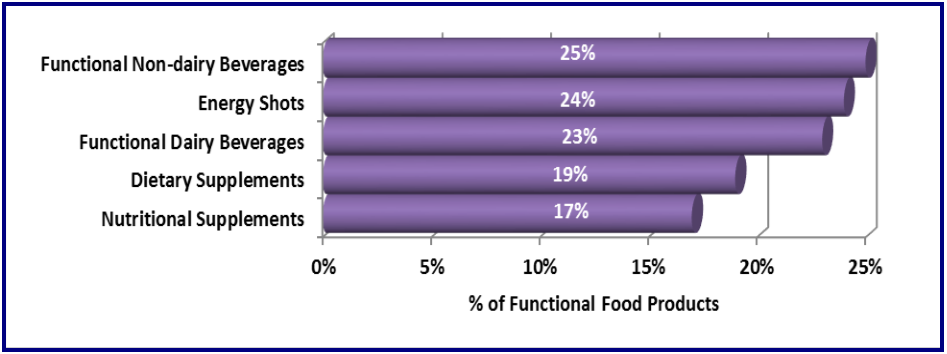

A recent survey of food processors5 regarding new product development of functional foods, functional beverages and dietary supplements revealed the following:

- 63 per cent of companies are developing or marketing functional foods.

- Of these companies, about 25 per cent produce or market functional, non-dairy beverages, 24 per cent work with energy shots, 23 per cent are involved with functional dairy beverages, 19 per cent work with dietary supplements. 17 per cent are involved in developing nutritional supplements including nutraceuticals, phytochemicals, herbs or botanicals. The findings are illustrated in Figure 2 .

- Food processors expect weight management and cardiovascular health to be the top issues for consideration over the next two years in developing foods, beverages and dietary supplements.

Figure 2: Functional Food Product Categories

Source: Packaged Facts

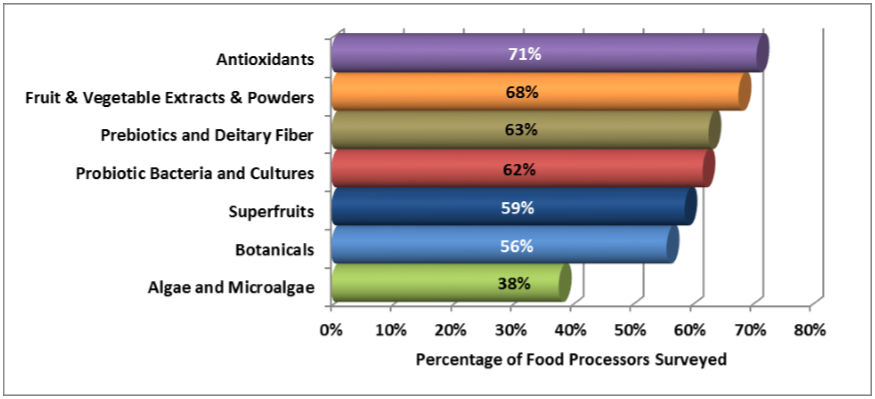

The ingredients and ingredient categories that food processors believe will be the most important over the next two years are illustrated in Figure 4.

Figure 4: Most Important Functional Food Ingredients in the Next Year

Source: BNP Media Inc.’s Market Research Division in collaboration with Prepared Foods magazine and NutraSolutions.com 11th annual survey of functional foods, functional beverages and dietary supplements, Packaged Facts

Functional Food & Beverage New Product Trends

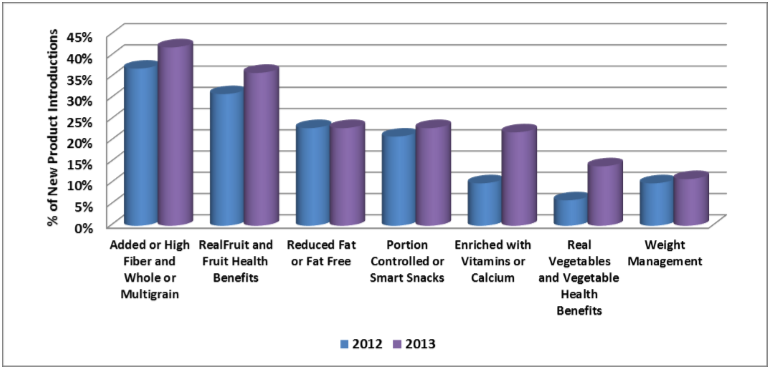

As compared with 2012 and illustrated in Figure 5, new food and beverage product introductions in 2013 showed an increase in better-for-you nutrition and

desirable benefits included:

- Real vegetables and vegetable health benefits (14%, up from 6%),

- Enriched with vitamins or calcium (22%, up from 10%)

- Real fruit and fruit health benefits (36%, up from 31%)

- Added or high fiber and whole or multigrain (42%, up from 37%).

In 2013 there was less growth in food and beverages offering better-for-you nutrition carrying “less” or “fewer” positioning. The greatest growth in this area was for

products carrying less or reduced calories and sugar-free claims, which increased to 57% from 51% in 2012.

Remaining essentially unchanged from 2012 were:

- Portion controlled or smart-snacks, which increased from 21% to 23%,

- New products with weight management positioning, which increased from 10% to 11%,,Reduced fat or fat-free positioning stayed the same at 23%.

Figure 5: Functional Food and Beverages New Product Introductions – 2012 - 2013

Source: Information Resources, Inc.

Challenge to Producing Functional Foods

According to a recent survey6 the key challenges associated with functional food development include:

- Achieving an acceptable taste profile, while delivering functionality

- Cost of the ingredients and marketing

- Increased competition

- Ingredient quality and dependability of supply

- Lack of clinical data, especially long term effects and information about interactions with other ingredients in a typical formulation7.

What Does this Mean?

- There are opportunities for Alberta’s primary and processing industries to capitalize on the growing demand for functional foods.

- Cost is an issue and offering price-sensitive consumers products, at a competitive price, can result in increased sales.

- Functional foods must have an acceptable taste profile, while delivering the targeted functionality.

- Increasing competition in the marketplace. Demand is growing and opportunities for consumer demand is growing as well.

- Although no one knows exactly the duration of interest in any food trend, the increased consumer awareness of health and wellness will continue to fuel interest in functional foods for the foreseeable future. Therefore the ingredients selected for use and potential claims to be made by food processors and marketers will reflect this trend.

Source

¨ Functional Foods: Key Trends Reports, Packaged Facts Market Research

,

1Merriam-Webster defines flavonoids as: any of a group of oxygen-containing aromatic antioxidant compounds that includes many common pigments (as the anthocyanins and flavones)

2Merriam-Webster defines isoflavones as: a bioactive ketone C15H10O2 noted for its numerous derivatives that are found in plants (as the soybean) and have antioxidant and estrogenic activity; also: any of these derivatives (as daidzein or genistein).

32013 International Food Information Council Functional Foods Consumer Survey, Media Webcast October 2, 2013

42013 International Food and Information Council Functional Foods Consumer Survey conducted with 1,005 Americans age 18 to 80, fielded in July 2013 with results weighted to reflect the American population

5BNP Media Inc.’s Market Research Division in collaboration with Prepared Foods magazine and NutraSolutions.com

6 BNP Media Inc.’s Market Research Division in collaboration with Prepared Foods magazine and NutraSolutions.com

7 www.nutrasolutions.com, June 25, 2014. |

|